Existing Store Growth

Promoting Brand Conversion and Store Remodeling in Line with Changes in the Market

Annual Average Sales Growth of 3–4%

Amid soaring raw material prices and uncertain social conditions, we assume the continuation of an external

environment that disallows profit under past business models. While taking advantage of the strengths of our vertical supply chain to achieve strategic cost reductions, we are placing a focus on further growth in same-store sales. In addition to the promotion of brand conversions and store remodeling in line with changes in the market and the implementation of strategic pricing strategies and sales promotions, we will pursue operational reforms at our table service restaurants to increase sales and profitability.

Results of Cost Reductions (Measures to Combat Inflation) in 2024

Soaring raw material prices

In response to soaring prices of raw materials, Skylark Group is working through a company-wide cost reduction project to reduce costs in all of our processes.

Level of reform

| Level 1 Purchasing reform |

- Price negotiations accompanying regulatory relaxation and changes in contract terms

- Change of production location (country) or diversification of business partners

- Control through bulk purchasing and long-term contracts

|

| Level 2 Production and logistics reform |

- Manufacturing work improvement

- Logistics efficiency improvement

- Expansion of internalization, automation

- Promotion of ingredients modules

|

| Levels 3, 4 Menu improvement |

- Efficiency through menu segmentation

- Gross profit improvement through optimization of prices

- Review of recipes and ingredients

- Reduction of food loss in stores

|

Existing Store Growth 1

Brand Conversion

Maximization of Area Profit is the Goal.

In 2025, Our Policy will Center on Syabu-Yo and Sukesan Udon.

Skylark Group does not perform brand conversions simply to improve the revenue of a single store. Our strength lies in brand conversions accompanied by careful calculation of impacts on other area Group stores to maximize revenue for the area.

In 2024, we carried out brand conversions at 64 stores, resulting in an approximate 49.6% increase in sales and 6.1% decrease in cannibalization. We are ramping up conversions to stores under the Syabu-Yo brand and the Sukesan Udon brand that we acquired in October 2024, and are optimizing our store portfolio in every region

Conversions in 2024

| Category |

Number of stores |

Impact in 2024 |

| Brand conversions |

64 |

Sales growth rate: 49.6%

De-cannibalization impact:6.1% |

2025 conversion policy

Our policy is to advance brand conversions centered on Syabu-Yo, our most profitable brand, and Sukesan Udon, which receives calls for store openings from around the country

Examples of area profit maximization

Store Remodeling

We are Renovating Stores to Meet Current Needs and Enhancing Store Visibility.

We Envision about 300 Store Renovations in 2025.

For each of our brands, Skylark Group undertakes design renovations tailored to the needs of the times. We are optimizing table ratios matched to customer group sizes and exterior designs that enhance store visibility, and are improving the placement of store signboards and guide signs. In 2024, we renovated 69 stores, mainly in the Gusto and Bamiyan brands, with a guest count impact of approximately +5%. We envision about 300 store renovations in 2025.

Store renovations in 2024

| Category |

Number of stores |

Impact in 2024 |

| Store renovation |

69 |

Guest count impact:+5.0% |

※Skylark Restaurants Co., Ltd. stores

Bamiyan Jingumae Store Remodeling impact▶6.6%

We added 11 counter seats and 4 partitions, along with other layout changes, resulting in an increase of 19 tables and 1 seat.

Jonathan’s Seya Ekimae Store Remodeling impact▶19.2%

Existing Store Growth 2

Enhancement of Store Service

Operational Visualization and Investment of Working Hours Yield Significant Improvement in Productivity and Profit Margin.

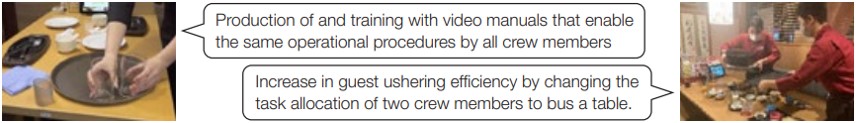

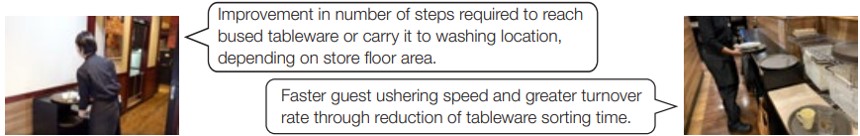

Skylark Group is working to increase productivity by minutely breaking down store operations and making improvements to tasks in every process. Our benchmark in doing so is “operational visualization.” In 2024, we visualized data on the time (clean-up time, or CU time) to complete table setting after customers vacate a table, carried out initiatives to shorten CU time, and increased the guest count effect through improved turnover rate.

Operational visualization⇨Realized through on-site checking and DX!

Reducing CU time in every process and improving turnover rate

Concrete initiatives

- Show vacated tables on tablet. Shorten time required to find tables to be bused.

- Training in faster table busing

- Reduction in walking and sorting times through placement and use of intermediate busing carts

Improvement impact

CU time is correlated with guest count. Stores that improve CU time tend to have a higher guest count than in the previous year. As an effective means of increasing guest count, we are currently carrying out store-specific data analysis and improvement activities.

CU improvement time (August to September)

Investment of working hours at weekend peaks

Improvement in labor cost ratio even with investment of working hours

During the era in which profit was generated through cost cutting, the reality was that stores missed out on sales by constraining working hours. In 2024, we reviewed per-store weekend sales, guest count, and required working hours and invested working hours during peak periods, successfully capturing full demand. The result is that we are building a business model by which labor cost ratio declines and profit increases even with investment of working hours.

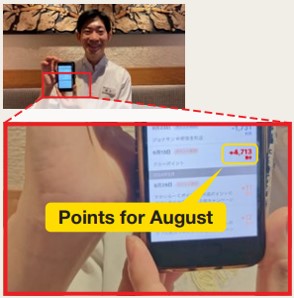

Utilization of crew points that support weekend working hour investment

At the end of April 2024, we began an initiative to grant Skylark points to crew members who work weekends and busy periods. In addition to contributing to capturing full demand by investing store working hours, this also contributes to higher employee motivation.

Earned points are set at headquarters while also reflecting regional factors such as individual store events.

Granting of 30-150 points per hour

Weekend working hours (before and after the introduction of crew points)

At table service restaurants, enhancing everyday store service is vital. Skylark Group will work to clarify issues through on-site checking and to exhaustively enhance service through data analysis, DX, video manuals, and equipment improvements.

Existing Store Growth 3

Marketing Advancements

We Improve Customer Experiential Value through Effective Data-Driven Marketing

Skylark Group positions “marketing advancement” as one of its key strategies for achieving sustainable growth in the increasingly competitive restaurant market. By breaking from past uniform menu promotions to instead engage in data-driven marketing, we aim to provide optimal value that meets the needs of individual customers.

Deepening our understanding of customers and promoting One to One marketing through the Skylark app

Making maximal use of CRM and boosting app membership by 60% through the introduction of Skylark App Points

The Skylark app is a valuable data source and an important touchpoint for interacting with over 12 million customer members. In May 2024, we introduced Skylark Points as our point platform. By analyzing customer attribute information, store history, order data, survey responses, and other data in detail, we are able to deeply understand the preferences and needs of every customer. Based on the findings of this analysis, we engage in One to One marketing by which we perform personalized coupon distribution, make menu recommendations, announce promotions, and more. This enhances experiential value for customers, enhances loyalty, and promotes continued store visits.

Creating demand and strengthening customer engagement through “dynamic coupons”

We are rolling out sales promotions that utilize diverse data including time of day, day of the week, customer attributes, and past usage history. From FY2024, in accordance with diversification of the market, we have been distributing more finely subdivided dynamic coupons. Consumption trends are diversifying by region. By issuing coupons that offer discount rates subdivided by prefecture instead of region and further by customer instead of by store, we will be able to achieve higherROI* sales promotions. We will also be able to implement flexible sales promotion measures tailored to specific purposes, such as attracting customers during quiet periods, boosting average check, and nurturing repeat customers. Customers who receive compelling coupons matched to their needs and circumstances are motivated to visit stores, which leads to enhanced engagement.

*ROI: Return on Investment, an indicator of how much profit was obtained from an amount invested.

Aims

| Customer attraction |

Strengthening cross-selling products |

| Promotion of repeat visits |

Normalization of discount rates |

| Return of defecting customers |

Area strategy (competitor countermeasures) |

| Invigoration of times of day |

Enhancement of average check |

Advancement of coupon strategy through the app

Organizational structure of menu and promotion based on brand characteristics

Skylark Group has over 20 brands, each with its own concept and customer base. To maximize the strengths of each brand, rather than implement uniform measures we plan and execute strategies tailored to each brand’s characteristics.

- Brand portfolio strategy and positioning of menu and promotion

Our brand portfolio is designed to meet wide-ranging customer needs. Each brand has a clear target customer, value provided, and brand image. Our menu and promotion strategy aims to deeply understand these elements and contribute to enhanced recognition, store visit promotion, and strengthening of customer loyalty for each brand.

- Deepening of menu development and sales promotion

For menu development, we are constructing a cycle by which the menu development team of each brand develops menus based on analyses by teams of data analysts and other experts, evaluates products that have been brought to market, and uses the data in further development.

- Measurement and improvement of promotion impacts

We strictly measure brand promotion strategies through metrics including sales, guest count, average check, gross profit, gross margin, customer satisfaction ratings, and ROI. Based on analysis of this data, we verify the impact of the strategies and continuously implement improvement measures to maximize the cost-effectiveness of promotions.

Example of a user community Syabu-Yo “Vegetable School, Shabu-shabu Club”

Syabu-Yo is advancing an initiative that incorporates co-creation with fans in menu development. In June 2023, the brand launched the fan community “Shabu-shabu Club.” Through this, the brand receives suggestions and recommendations for menu development. As one related activity, it launched the “New Dashi Development Project.”

New dashi (broth) development by fan community

Our “Hakata Pork Bone Dashi,” conceived in the first session, was selected by customers at 4.3times the average rate of dashi in past campaign fairs

Maximization of profit through “regional pricing” strategies

At Gusto, a brand with stores in every prefecture, we have introduced four regional pricing strategies that take into account regions’ market characteristics, competitive conditions, and customer price sensitivity. Through this, we optimize pricing in line with each region’s demand and work to maximize profit. Pricing based on detailed market analysis fosters a sense of appropriateness among customers and contributes to the establishment of a competitive advantage.