Last Updated: March 1, 2024

Five-year Financial Summaries

Click to Download XLS File

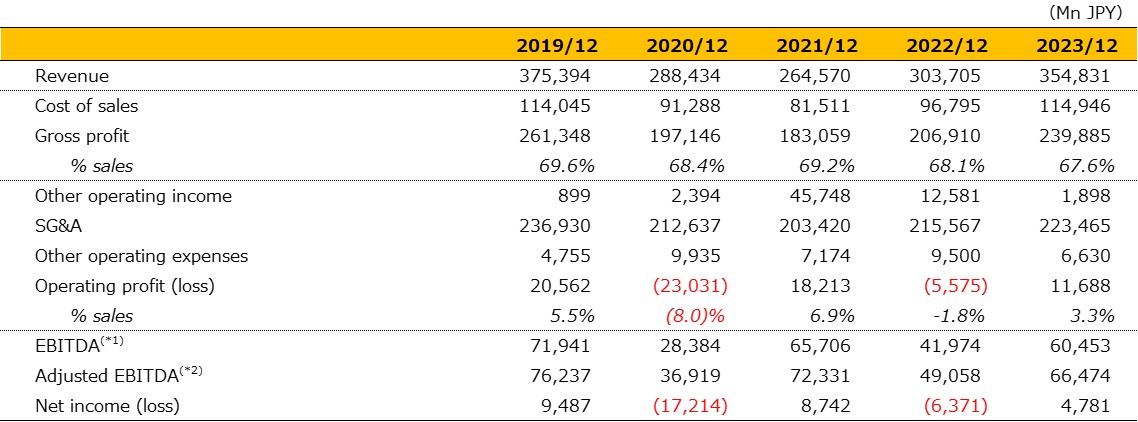

Consolidated Statements of Income

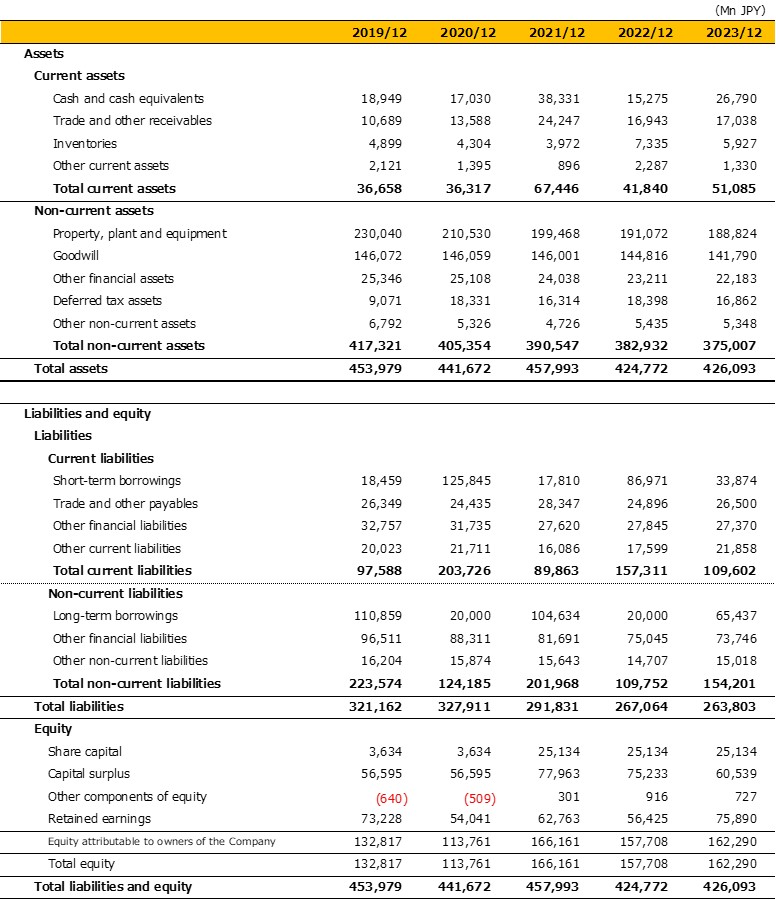

Consolidated Statements of Financial Position

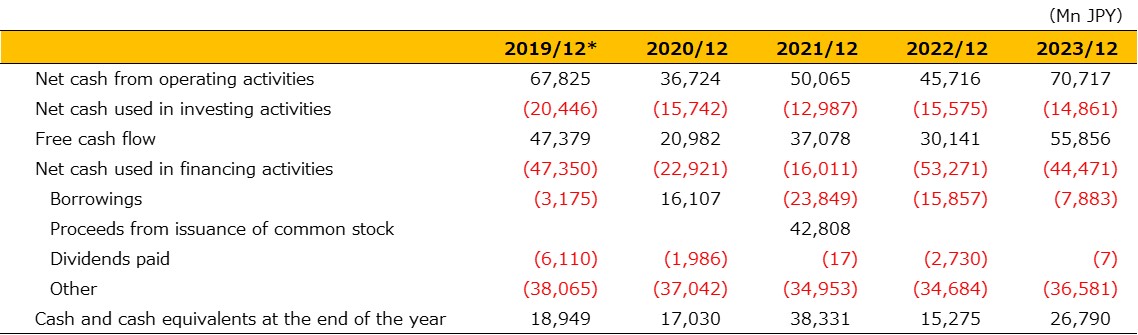

Consolidated Statements of Cash Flows

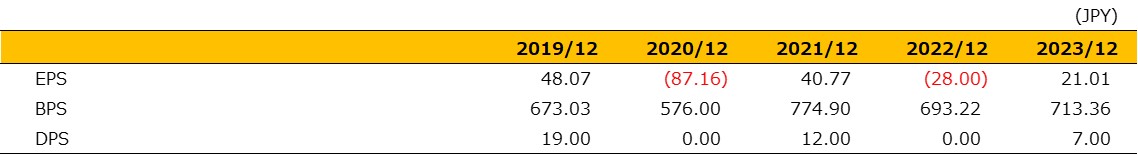

Per Share Information

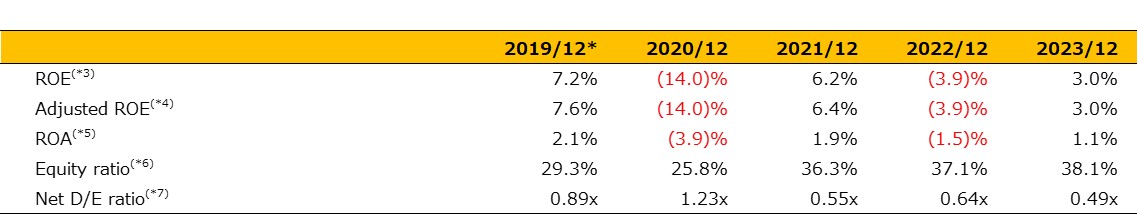

Financial Indicators

- (*1)EBITDA= Income before income taxes + Interest Expense + Loss on redemption of borrowings before the repayment date and gain and loss from associated hedge transactions + Other financial expenses (excluding loss on redemption of borrowings before the repayment date and gain and loss from associated hedge transactions) - Interest income - Other financial income + Depreciation and amortization + Amortization of long-term prepaid expenses + Amortization of long-term prepaid expenses (deposits)

- (*2)Adjusted EBITDA = EBITDA + Loss on disposal of fixed assets + Impairment loss of non-financial assets – Reversal of impairment loss of non-financial assets + public offering-related expenses

- (*3)ROE=Net income (loss) attributable to owners of the Company (LTM) / Total equity (average during the period)

- (*4)Adjusted ROE= Adjusted net income (loss) (LTM) / Total equity (average during the period)

- (*5)ROA=Net income (loss) attributable to owners of the Company (LTM) / Total equity (year-end)

- (*6)Equity ratio=Equity attributable to owners of the Company (year-end) / Total equity (year-end)

- (*7)Net D/E ratio =(Borrowings at end of period + other financial liabilities at end of period - cash and cash equivalents at end of period - financial liabilities associated with IFRS16) / Total equity (year-end)

- *With the adoption of IFRS16 (new lease accounting standard) in 2019, all leases, with some exceptions, are recognized on-balance sheet as assets and liabilities.

The effects of this change result in the recording of assets and liabilities on the balance sheet from 2019 onwards, and a decrease in the equity ratio.

In addition, EBITDA increased by the same amount due to the conversion of expenses formerly recorded as rent (mainly store lease expenses) to depreciation and amortization. Simultaneously, operating cash flow increased, while financing cash flow decreased.