Policy and Approach

Skylark Group endorses the Taskforce on Nature-related Financial Disclosures (TNFD). In May 2024, we joined the TNFD Forum, a consultative group of organizations supporting the development of a framework for managing and disclosing nature-related risks.

In line with the Kunming-Montreal Global Biodiversity Framework, we support the "Nature Positive" goal of halting and reversing biodiversity loss by 2030. Based on our assessments of the company’s dependencies and impacts on biodiversity and ecosystem services, we will collaborate with suppliers and business partners while promoting engagement with nature-related stakeholders.

Furthermore, we aim to achieve a net positive impact by 2030. We will strive to minimize the negative impacts of our business activities on biodiversity and contribute to the improvement of the natural environment.

Additionally, we will utilize the LEAP approach* recommended by the TNFD to analyze our nature-related dependencies, impacts, risks, and opportunities. We will organize our initiatives and analysis in line with the four pillars of the TNFD framework: Governance, Strategy, Risk and Impact Management, and Metrics and Targets.

*The LEAP approach is a method for prioritizing impacts and actions related to natural capital, with a focus on location. It guides the user to Locate their interface with nature, Evaluate their dependencies and impacts, Assess their risks and opportunities, and Prepare to respond to nature-related risks and opportunities and report on them.

Status of Our Response to TNFD Recommendation

As a “TNFD Adopter,” Skylark Group began disclosing information in line with TNFD recommendations in May 2024. Disclosures recommended by the TCFD (Task Force on Climate-related Financial Disclosures) Final Recommendations and TNFD (Task Force on Nature-related Financial Disclosures) Final Recommendations V1.0.

Click here for TNFD report ⇒ /Portals/0/images/sustainability/environment/TNFD/TNFD_report_en_251015.pdf

Click here for TCFD and TNFD comparison table ⇒ https://corp.skylark.co.jp/en/sustainability/environment/tcfd_tnfd/

Governance

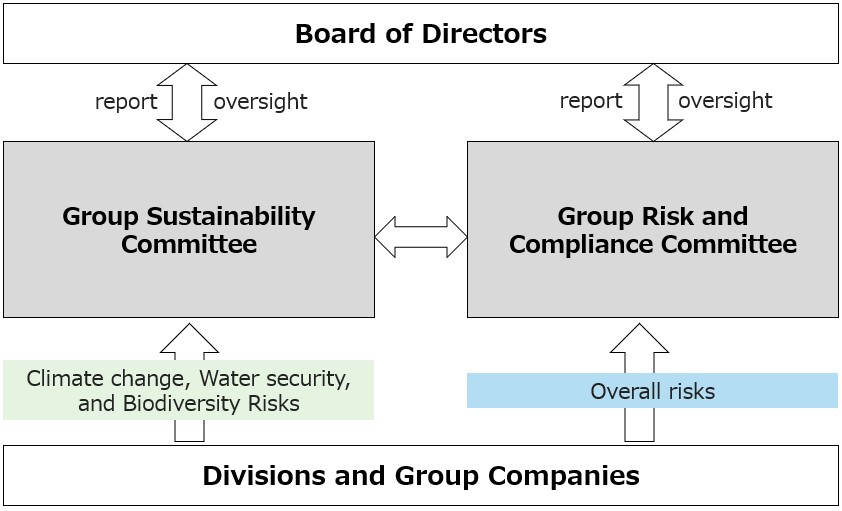

Under the supervision of the Board of Directors, we have established a governance structure to promote sustainability management across the Group, including the "Group Sustainability Committee" as the decision-making body for initiatives related to natural capital such as climate change, conservation of water resources, and biodiversity.

Risk and Impact Management

- Process for identifying impacts/dependencies and risks/opportunities related to natural capital

We identify the dependence and impact of our Group's direct operations and value chain on natural capital by utilizing multiple tools recommended by the TNFD. In the "priority areas" where biodiversity and financial risks are of particular concern, we identify and evaluate risks and opportunities related to natural capital.

(The specific process is described in the "Strategy" section.)

- Risk Management System

Mid- to long-term risks and opportunities related to climate change, water resources, and biodiversity are overseen by the Group Sustainability Committee, while overall risk management is governed by the Group Risk and Compliance Committee.Through this collaboration, identified biodiversity risks are integrated into company-wide, multi-disciplinary risk management processes, and are prioritized and response measures are formulated using the same criteria as other material risks. Both committees work in collaboration, designating a department responsible for each risk to ensure appropriate preventive and responsive measures are taken. The deliberations of both committees are shared with Outside Directors to ensure the transparency of the risk management system. Additionally, Outside Directors serve as advisors to both committees, allowing us to receive input and advice from an external perspective. The Board of Directors receives regular reports from the Group Sustainability Committee and oversees the status and management of these risks.

Strategy

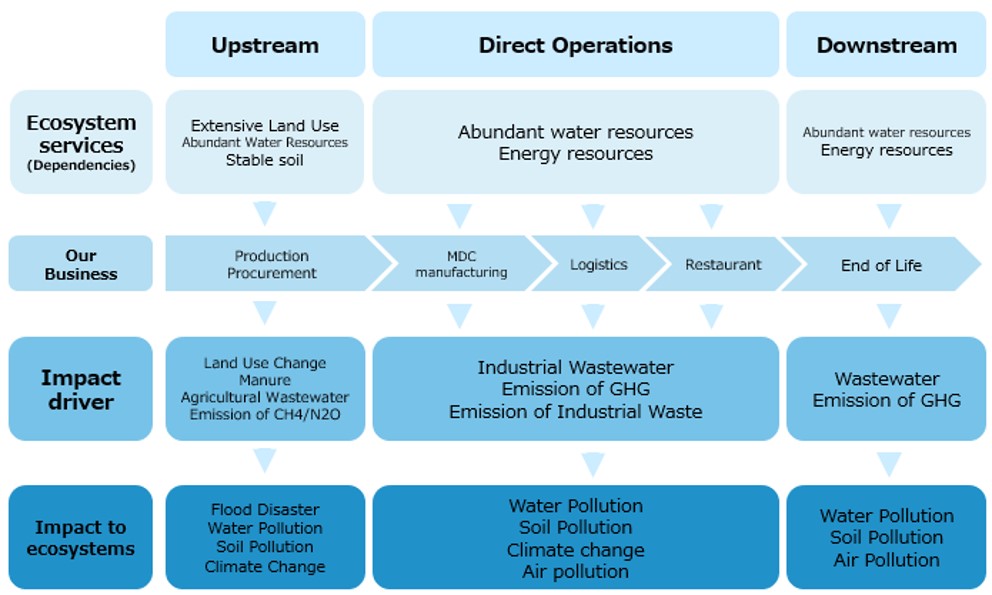

In accordance with the TNFD recommendations, we have systematically organized the relationship of dependence and impact between our business activities and natural capital to better understand them.

In this analysis, considering the accuracy of the available data, we have set the scope to our upstream value chain and direct operations. We will continue to analyze and investigate data concerning waste disposal, which constitutes our downstream value chain.

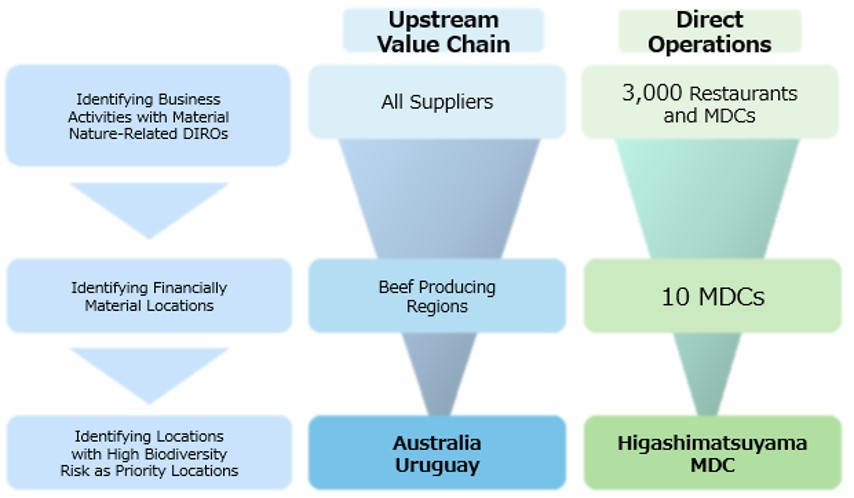

Next, in accordance with the "LEAP approach" recommended by the TNFD, we identified risks and opportunities related to the dependence and impact of our business activities on natural capital, and examined response measures through the following process. In this assessment, we have adopted a "location-specific approach" utilizing external tools such as the WWF Biodiversity Risk Filter and IBAT to analyze the degree of dependence and impact on ecosystems at specific raw material procurement regions and business locations.

Specific Process

- Identification of business activities with high-materiality dependence and impacts on natural capital

Using "ENCORE," we confirmed the materiality of our business activities (upstream and direct operations) in terms of dependence and impact on natural capital, and identified business activities with particularly high materiality.

- Identification of locations with high financial impact on our company

➡【Upstream Value Chain】

Utilizing SBTN's "HICL," we identified raw materials with high nature-related risks. "Beef," which accounts for the largest purchase amount, was identified.

➡【Direct Operations】

We identified our Merchandising Centers (MDCs), which serve as central kitchens for our stores.

- Identification of locations with high biodiversity risk

Utilizing tools such as IBAT, Global Forest Watch, and WRI Aqueduct, we identified locations with high biodiversity risk from the sites identified in step 2 as "priority areas."

Upstream Value Chain: Beef production areas "Australia" and "Uruguay"

Direct Operations: "Higashimatsuyama MDC" (Higashi-Matsuyama City, Saitama Prefecture)

- Identification of risks and opportunities and examination of countermeasures in priority areas

We evaluate the degree of impact of risks and opportunities using multiple scenarios advocated by the TNFD.

Specific Process

Details of the Scenarios

【Excerpt】 Risks, Opportunities, and Response Measures in Beef Production Areas

|

Category |

Item |

Period of Influence |

Primary Risks and Opportunities to us |

Impact Assessment |

Our Countermeasures (Examples) |

| Scenario #1 |

Scenario #3 |

| Transition Risk |

Policy |

Enhanced taxation and traceability |

Medium to long term |

Increased store operating costs due to new taxes and regulations, increased raw material procurement costs, manufacturing costs, packaging costs, and logistics costs |

Large |

Medium |

|

| Market |

Penetration of certification systems such as sustainable cattle and livestock GAP |

Short to long term |

Decrease in revenue due to changes in consumer demand |

Medium |

Small |

| Reputation |

Damage to brand value |

Short to long term |

Decrease in revenue due to loss of trust from society and deterioration of brand image due to delay in addressing biodiversity issues |

Medium |

Small |

| Physical Risk |

Acute |

Induced flooding and flood damage due to land conversion |

Short to long term |

Soaring raw material prices and increased costs of procuring alternative food materials |

Medium |

Large |

|

| Chronic |

Impact of environmental degradation on the growth of beef cattle, including epidemics |

Medium to long term |

Small |

Medium |

| Opportunity |

Market |

Transformation of consumer behavior and preferences |

Short to long term |

Introduce environmentally friendly menus and develop brands |

Medium |

Small |

|

| Reputation |

Increased stakeholder awareness |

Short to long term |

Increase in stock price due to inflows from the investor community |

Medium |

Small |

|

【Excerpt】Risks, Opportunities, and Response Measures at the Higashimatsuyama MDC

|

Category |

Item |

Period of Influence |

Risks and Opportunities to us |

Impact Assessment |

Our Countermeasures (Examples) |

| Scenario #1 |

Scenario #3 |

| Transition Risk |

Policy |

Tighter regulations on wastewater and waste |

Medium to long term |

Increased costs due to new taxes and regulations, increased manufacturing and distribution costs |

Large |

Medium |

|

| Market |

Transformation of consumer behavior and preferences |

Short to long term |

Decrease in revenue due to changes in consumer demand |

Medium |

Small |

|

| Reputation |

Damage to brand value |

Short to long term |

Decrease in revenue due to loss of trust from society and deterioration of brand image due to delay in addressing biodiversity issues |

Medium |

Small |

|

| Physical Risk |

Acute |

Increase in natural disasters |

Short to long term |

Decrease in revenue due to MDC shutdown |

Medium |

Large |

|

| Chronic |

Water pollution of rivers due to environmental degradation |

Medium to long term |

Increased management costs due to deteriorating water quality |

Small |

Medium |

|

| Opportunity |

Market |

Increasing intensity and frequency of disasters |

Medium to long term |

Enhancement of public trust and reputation through disaster response |

Medium |

Small |

|

| Reputation |

Promote initiatives to prevent environmental pollution |

Medium to long term |

Improved contribution to local communities by promoting initiatives |

Medium |

Small |

|

Financial Impact Assessment

We quantitatively assessed the financial impact of the identified risks and opportunities.

Regarding physical risks, although our factories are not located in areas with high water stress, we assessed the risk of water supply disruptions at the Higashi-Matsuyama MDC, considering its significant dependence on water resources. We calculated the financial impact based on past information on water intake restrictions and supply cuts issued by local governments. As a result of the assessment and calculation, we confirmed that even in a situation where the Higashi-Matsuyama MDC is forced to halt operations for three months due to drought or water supply cuts, we have a system in place to minimize the damage by transferring operations to other MDCs and revising delivery routes and production systems. This affirmed that the diversification and dispersion of our production bases contribute to strengthening our resilience to natural disasters.

*Calculation of cost savings assumed upon achieving reduction targets

Indicators and Targets

At our company, we track business activities that could impact the environment by gathering data on GHG emissions, water withdrawal and discharge volumes, food waste, and petroleum-derived plastic use. We also manage the percentage of certified products for domestic vegetables, palm oil, and paper products.

For each of these indicators, we set annual KPIs with the relevant departments and drive these initiatives by reporting progress to the Sustainability Committee quarterly.

Moving forward, we will continue to monitor and analyze these key data points. We

will also advance discussions within the Sustainability Committee regarding the addition of new indicators to manage and the setting of future targets.

| metric NO. |

Core Global Metrics |

Status |

| ー |

GHG Emissions |

Included in the Sustainability Report

|

| C1.0 |

Total spatial footprint |

Total surface area controlled/managed

Restaurants: 865,274.7 ㎡

MDCs : 63,714.1 ㎡

Offices : 6,220.8 ㎡

Total disturbed area

Not implemented due to lack of information and resources

Total rehabilitated/restored area

Not implemented due to lack of information and resources

|

| C1.1 |

Extent of land/ freshwater/ ocean-use change |

Not implemented due to lack of information and resources |

| C2.0 |

Pollutants released to soil split by type |

Not implemented due to lack of information and resources |

| C2.1 |

Wastewater discharged |

Total volume of water discharged

Included in the Sustainability Report

Concentrations of key pollutants in the wastewater discharged, by type of pollutant, referring to sector-specific guidance for types of pollutants;

Not implemented due to lack of information and resources

Temperature of water discharged

Not implemented due to lack of information and resources |

| C2.2 |

Waste generation and disposal |

Included in the Sustainability Report |

| C2.3 |

Plastic pollution |

Petroleum-derived plastics weight

Included in the Sustainability Report

Plastic footprint as measured by total weight

Not implemented due to lack of information and resources |

| C2.4 |

Non-GHG air pollutants |

Non-GHG air pollutants by type

Not implemented due to lack of information and resources |

| C3.0 |

Water withdrawal and consumption from areas of water scarcity |

Total water intake

Included in the Sustainability Report

Water withdrawal and consumption from areas of water scarcity 4844 (m3) |

| C3.1 |

Quantity of high-risk natural commodities sourced from land/ ocean/ freshwater |

Not implemented due to lack of information and resources

Currently considering future responses, focusing on Beef and Palm Oil |

| C4.0 |

Placeholder indicator: Measures against unintentional introduction of invasive alien species |

This metric is a placeholder and detailed criteria have not been determined, so Not Implemented |

| C5.0 |

Placeholder indicator: Ecosystem condition |

This metric is a placeholder and detailed criteria have not been determined, so Not Implemented. |

| C7.0 |

Value of assets, liabilities, revenue and expenses that are assessed as vulnerable to nature-related transition risks |

In the 'Strategy' section, we have quantitatively assessed the financial impact of transition risks. |

| C7.1 |

Value of assets, liabilities, revenue and expenses that are assessed as vulnerable to nature-related physical risks |

In the 'Strategy' section, we have quantitatively assessed the financial impact of physical risks. |

| C7.2 |

Description and value of significant fines/penalties received/litigation action in the year due to negative nature-related impacts |

In FY2024, there were no significant fines, penalties, or litigation actions related to negative nature-related impacts |

| C7.3 |

Amount of capital expenditure, financing or investment deployed towards nature-related opportunities, by type of opportunity, with reference to a government or regulator green investment taxonomy or third-party industry or NGO taxonomy |

Not implemented due to lack of information and resources |

| C7.4 |

Increase and proportion of revenue from products and services producing demonstrable positive impacts on nature with a description of impacts |

Revenue of wooden cutlery in fiscal year 2024 were approximately JPY 25.5 million. |